|

||||

|

In this update:

Senate Passes 2022-23 State Budget that Cuts Taxes, Funds Essential Services

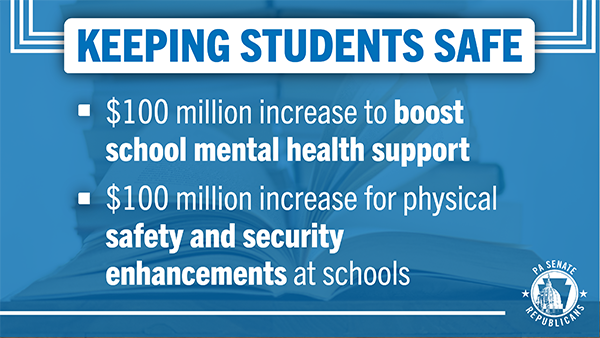

The Senate approved a $45.2 billion General Fund Budget for Fiscal Year 2022-23 that meets the needs of Pennsylvanians today without creating multi-billion-dollar budget deficits in the future. Senate Bill 1100 was sent to the governor for enactment. The $45.2 billion budget, which also includes federal American Rescue Plan Act (ARPA) funds, represents a 2.9% increase over the previous year’s spending – and $500 million less than Gov. Tom Wolf’s original budget request. Tax Cuts to Attract Employers and Residents The budget agreement does not include any broad-based tax increases and is structured in a way to minimize the risk of tax increases in the years ahead. In fact, the budget actually cuts the Corporate Net Income tax rate from 9.99% to 8.99% and creates a phased reduction to 4.99% by 2031, moves designed to attract employers and residents to Pennsylvania. Other changes also ensure out-of-state companies that do business in Pennsylvania pay the proper amount of taxes; modernize expense deductions for small businesses, allowing small business owners more flexibility and tax planning opportunities; and provide tax incentives for small businesses to grow and invest in Pennsylvania. Protecting Taxpayers in Future Years As important as the economic boost provided by this plan, which will have a projected ending balance of $3.6 billion, the 2022-23 budget includes a $2.1 billion transfer to the Rainy Day Fund, bringing the total balance to nearly $5 billion. These fiscally responsible steps are critical because many economic indicators are showing a risk of a recession on the horizon. Most recently, Pennsylvania’s Independent Fiscal Office estimated a 60% chance of economic stagnation or a “growth recession” happening, and a 30% chance of a recession. Supporting Education The budget includes a $525 million increase for Basic Education Funding, $225 million to provide additional support for the state’s 100 poorest school districts, a $100 million increase for Special Education funding, an additional $60 million for Pre-K Counts and $19 million more for Head Start Supplemental Assistance. It also includes an additional $125 million in Education Improvement Tax Credits to ensure more students can learn in the educational environment that best suits their needs. Higher education receives a funding boost as well. Increased funding is also dedicated in this year’s budget to ensure our schools are safe and secure: $100 million is appropriated for the Ready to Learn Block Grant program to address school-based mental health; and $100 million in funding is directed to a new General Fund appropriation for School Safety and Security to address physical safety and security at schools. Long-Term Care, Housing and Fuel Building on our efforts last year to help address the serious financial challenges of our nursing homes and long-term care providers, this budget includes $150 million for costs related to nursing home staffing, $250 million in ARPA funding for long-term living programs and $20 million for supplementary payments to personal care homes. Inflation is driving up the cost of everything, including housing, both owned and rented, and this budget directs $540 million in ARPA funding to help our most vulnerable and low-income residents by funding affordable housing construction programs, offering additional home repair assistance and bolstering the Low Income Home Energy Assistance Program and the Property Tax/Rent Rebate Program. Other Highlights of the New Budget

Statement on Commonwealth Court’s RGGI RulingThe consumers of electricity in this commonwealth and the working families in our energy sector received important news, positive news, this past week because the Commonwealth Court has put a stop to Gov. Wolf’s proposed carbon tax, by granting a preliminary injunction that delays Pennsylvania’s entry into the Regional Greenhouse Gas Initiative (RGGI) pending further court action. This carbon tax would make the production of electricity in our commonwealth even more expensive and uncompetitive compared to the rest of the states. That is a direct threat to working families in this commonwealth and a direct burden on every consumer of electricity in this commonwealth. So, it was a significant victory. I expect there will be more appeals and more legal gymnastics to occur, but this was very important because it speaks to the importance of co-equal governance, it speaks to the reality that the governor cannot unilaterally impose a tax and it speaks to the need for us to protect energy workers in our commonwealth. This is an important victory, but there are many more steps to go in the process. But I’m very encouraged by what we received from the Commonwealth Court today. My hope is that the governor takes a step back and truly engages the legislature in coming up with a proper energy policy in this commonwealth. Senate Approves Pittman Prescription Eye Drops Refill BillThe state Senate has approved my legislation, Senate Bill 1201, that would reduce the waiting time for Pennsylvanians to get refills of their prescription eyedrops. When people self-administer eye drops, a certain amount goes unused due to spills or other factors. Currently in Pennsylvania, when a person runs out of their prescription eye drops prior to the expiration of the intended period of use and returns to their pharmacist seeking a refill, coverage may be denied. As a result, they are unable to refill their eye drops when needed. This causes people to either ration the remaining medication or go without. SB 1201 would require that health insurance policies issued or renewed in Pennsylvania provide coverage for prescription eye drop refills at 70% of the prescribed duration. Early refills shall be covered at 21 days for a 30-day supply, 42 days for a 60-day supply, and 63 days for a 90-day supply. The eye drops must be prescribed by a health care practitioner and be a covered benefit, and the number of refills may not exceed the number indicated on the original prescription. The bill now heads to the state House of Representatives for consideration. Stacking Option for Auto Insurance Legislation Approved by SenateThe Senate this past week approved my legislation that seeks to take some of the confusion out of purchasing auto insurance in Pennsylvania. The source of the confusion Senate Bill 676 seeks to address is the “stacking” option. Stacked insurance is the combining, or “stacking,” of Uninsured and Under Insured Motorist (UM/UIM) coverage limits on multiple vehicles to increase the amount for which you would be covered in case of an accident. Current state law contains language that prohibits a consumer from purchasing more UM/UIM coverage than Bodily Injury (BI) coverage. However, those provisions in the law were circumvented in 1990, giving consumers with more than one vehicle (cars and motorcycles) the ability to “stack” their UM/UIM coverage for each vehicle they own, unless they have previously waived the coverage. That means a consumer can have more UM/UIM coverage than BI coverage, but only if they have more than one vehicle and if they want that coverage to be the multiple of however many vehicles they happen to own at a given time. SB 676 would address that confusing and convoluted situation and make the stacking of uninsured and underinsured benefits coverage obsolete by allowing insured individuals to purchase a preferred amount of Uninsured Motorist or Underinsured Motorist (UM/UIM) coverage. Our auto insurance laws in this state need to be updated, and I believe SB 676 goes a long way to do that; this bill is a carefully crafted compromise that’s pro-consumer, pro-transparency and focused on consumer protection. The bill now heads to the state House of Representatives for consideration. Bill Containing Constitutional Questions for PA Voters AdvancesThe Senate this past week approved a set of proposed amendments to the Pennsylvania Constitution. Fifty-seven times the Pennsylvania General Assembly has posed the question to the state’s voters as to whether or not they want to amend the Constitution of this commonwealth. In Senate Bill 106, we have very significant constitutional questions that will ultimately be answered by the voters. SB 106 contains proposals that would:

A proposed constitutional amendment must pass the General Assembly during two separate and consecutive legislative sessions before it is presented to the voters for consideration. Indiana Rotary Club 100th Anniversary

Earlier this week, I had the honor of joining the Indiana Rotary Club to present club president Ashlee Kennedy with a citation celebrating their 100 year anniversary. The Indiana Rotary Club, along with all Rotary clubs, follows the idea of “Service Above Self.” During their 100 years, they have always been community minded, both locally and internationally. You have my utmost appreciation for ALL that you do for our community. Congratulations on 100 years of service and best wishes for many more! Annual Government Day Service

My thanks to Pastor Paul Price of Cornerstone Worship Center in Indiana for organizing the annual Government Day Service last Sunday. I enjoyed the opportunity to gather and reflect on the responsibilities of serving in an elected position. The blessing and prayers bestowed upon us were greatly appreciated – thank you for having me! |

||||

|

||||

Want to change how you receive these emails? 2025 © Senate of Pennsylvania | https://senatorpittman.com | Privacy Policy |